“ILOE” This mandatory insurance scheme, managed by the Ministry of Human Resources and Emiratization (MOHRE), is a social security UAE for workers in both the public sector and private sector. It offers temporary financial assistance, income protection UAE, and unemployment benefits UAE in case of involuntary job loss.

This guide covers the ILOE Scheme for 2025, including ILOE eligibility criteria, ILOE premium cost, ILOE benefits, Plans, and the ILOE claim process, avoiding common mistakes ILOE claim, and managing your subscription for continuous financial security and financial backup.

What is ILOE Insurance UAE?

ILOE (Involuntary Loss of Employment Insurance) as per Federal Decree Law No. 13 of 2022 is a government mandated financial protection. The ILOE program provides unemployment benefit as a cash payment to eligible Emiratis and UAE resident expatriates in the federal government and private sector who lose their job due to redundancy (not termination for cause).

It’s a temporary income replacement and a financial safety net. The scheme is part of social security UAE and is managed by the Insurance Pool UAE represented by the Insurance Pool Provider, Dubai Insurance Company.

Is ILOE Insurance Mandatory in the UAE?

ILOE Scheme is a compulsory insurance UAE for eligible employees. New workers must subscribe ILOE Insurance within 4 months of getting work permit UAE.

Non-compliance will result in an initial ILOE fine of AED 400 and will affect future work permit applications. Employee is responsible to enroll in ILOE and pay ILOE premiums. Adhere to avoid ILOE fines and penalties and keep this financial backup.

ILOE Eligibility Criteria

ILOE eligibility criteria requires subscription from UAE Nationals and residents (expats UAE) in the private sector UAE, federal government / public sector, and Free Zone.

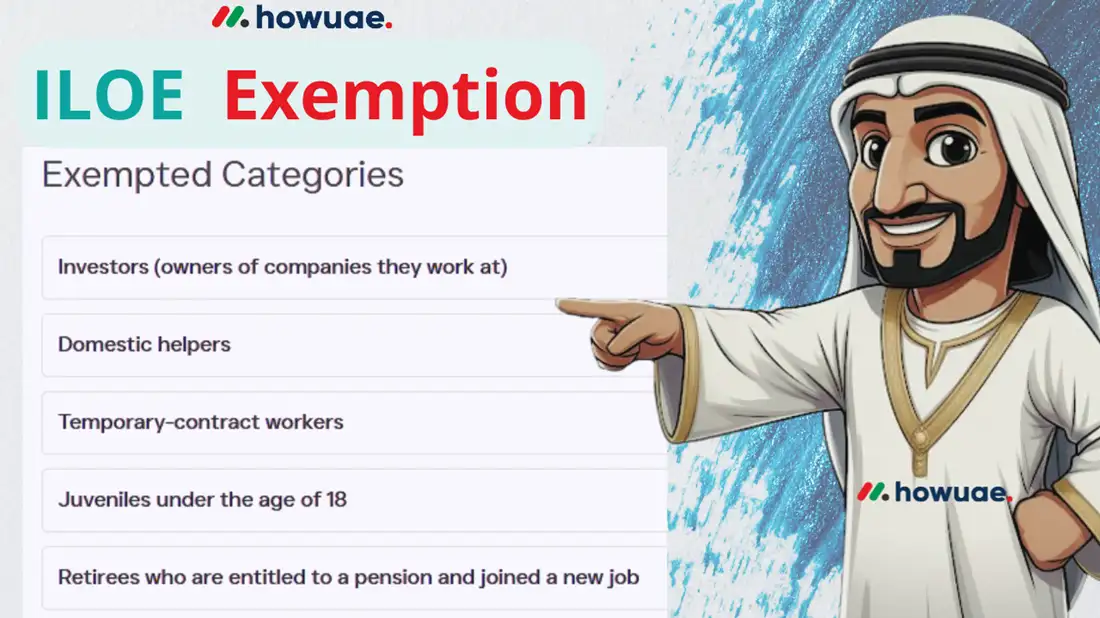

ILOE Exempted Categories

Specific exempted categories ILOE are investors/business owners, domestic workers, temporary contract workers, minors under 18, and retirees on pension who take up new employment. Eligibility requires being present in UAE with a UAE residency visa and Emirates ID.

ILOE Plans (Benefits)

You can Choose the right protection plan based on your basic salary category.

CATEGORY A

Basic Salary 16,000 AED or below

5 AED + VAT / MONTH

Compensation Benefit

Up to 10,000 AED / month

CATEGORY B

Basic Salary Above 16,000 AED

10 AED + VAT / MONTH

Compensation Benefit

Up to 20,000 AED / month

Disclaimer: Policy period is available for 1 year or 2 years. The full VAT amount is added to the first installment/payment. For More Check ILOE Website.

ILOE Subscription Costs (2025)

The ILOE subscription cost uses a two-tier system based on basic salary:

- ILOE Category A: For salaries ≤ AED 16,000/month. AED 5 + VAT monthly (AED 60 + VAT annually).

- ILOE Category B: For salaries > AED 16,000/month. AED 10 + VAT monthly (AED 120 + VAT annually). VAT is 5%.

Flexible ILOE premium payment options.

- ILOE Portal (iloe.ae)

- ILOE Mobile App

- MBME Pay

- Upay

- Bank Apps

- Bank ATMs

- Al Ansari Exchange

- Business Service Centres

- SMS/Telecom bills

- Botim

- C3Pay

To subscribe ILOE insurance and pay ILOE premiums, use any of the above ILOE payment channels.

You can choose how often you want to pay your ILOE premium from the following flexible options:

- Monthly

- Quarterly (every 3 months)

- Semi-annually (every 6 months)

- Annually (once a year)

ILOE Insurance Benefits & Compensations

ILOE benefits gives you financial support unemployment. The calculation of benefits gives you 60% of salary benefit based on your average basic salary of the last 6-12 months before job loss.

This ILOE payout (cash benefit/monthly benefit) gives you income protection UAE for up to 3 consecutive months per claim. There is a monthly payout cap ILOE (maximum benefit cap / claim capping): AED 10,000 for Category A and AED 20,000 for Category B.

A total lifetime benefit limit ILOE of 12 monthly benefits applies throughout your UAE working life. This ILOE benefit helps during job transitions.

Related: “Resignation Letter Sample” | “How to Close Mashreq Neo” | Lulu Balance Check

How to Claim ILOE Insurance Benefits: Step-by-Step

To claim ILOE insurance, adhere to the following ILOE claim process:

Claim Eligibility Conditions:

- Completed minimum contribution period: 12 consecutive months with premiums paid.

- Reason for job loss is involuntary job loss (redundancy/layoff); excludes disqualification reasons like resignation or disciplinary dismissal. Other reasons like misconduct, fraud, an active absconding complaint, or the employer being fictitious also disqualify. Job loss due to non-peaceful strikes is not covered.

- Must be legally present in UAE.

- Submit ILOE claim within the claim filing deadline: 30 days of termination/labour complaint settlement.

Step-by-Step Claim Guide:

- Check Eligibility: Confirm you meet all pre-requisites to file ILOE.

- Gather Required Documents ILOE Claim: Collect your Termination Letter/Proof of Termination, Emirates ID, Salary Proof (Salary Slips/Bank Statements for the last 6 months), ILOE Policy Details / ILOE Certificate number, and IBAN (for bank transfer).

- Submit Claim: Use the ILOE Official Claims Portal (iloe.ae), ILOE Mobile App, or ILOE Call Centre (600 599 555) to file ILOE claim within 30 days.

- Claim Processing: Wait for claim processing time ILOE (approx. 2 weeks / 14-30 days). Track ILOE claim status / monitor claim via the portal/app.

- Get Payout: Approved ILOE benefits will be transferred to your Bank Account or for collection at an Exchange House. Knowing how to claim ILOE benefits ensures you get it on time.

ILOE User Manual

Mistakes To Avoid When Claiming ILOE

Avoid these common ILOE claim mistakes to prevent delays or claim rejection:

- Missing the 30 day deadline.

- Incomplete documents/missing documents or wrong information/discrepancies.

- Unpaid premiums or lapsed policy.

- Claiming after resignation or disciplinary dismissal (key reasons for ILOE claim denial).

- Not meeting the 12 months consecutive contribution period or other eligibility criteria.

- Delaying responses to insurer’s requests.

LOE Denied Claim Appeal Process?

If your ILOE claim denied/claim rejected happens, follow this appeal process for resolving ILOE claim issues:

- Understand Denial: Contact the insurer (claims@iloe.ae / 600 599 555) for the reason.

- Gather Evidence: Collect documents to refute the denial reason.

- Submit Appeal/Reconsideration: Appeal through the insurer’s designated channel.

- Escalate to MOHRE: If dispute handling fails, file complaint MOHRE (Ministry of Human Resources and Emiratisation).

- Get Legal Advice: Consider consulting for complex dispute resolution.

Knowing how to appeal ILOE decision and act fast will increase your chances of a successful appeal ILOE claim denial.

ILOE Subscription Renewals and Fines

Don’t forget to manage your ILOE Insurance after you’ve signed up. Here’s what you need to know about ILOE subscription management:

Unpaid Fines: Authorities can implement ILOE fines collection through WPS deduction, deduction from end of service benefits or other methods approved by MOHRE. Unpaid fines can affect work permit or visa renewal.

Why Renewal is Important: You need to renew ILOE Insurance (policies are usually annual or bi-annual) to maintain continuous coverage. A lapse means you might not meet the 12 months consecutive requirement if you need to file ILOE claim later. Check your ILOE Certificate / Certificate of Insurance for expiry dates. You can often download ILOE certificate online via the portal.

Renewal Process: Use the same channels as subscription – ILOE Portal, ILOE App, Kiosks, etc.

ILOE Fines for Non-Compliance:

- Fine for Not Subscribing ILOE / Failure to Enroll: AED 400 (initial fine).

- Fine for Late Premium Payment / Unpaid Premiums: AED 200 if premiums are not paid within 3 months of the due date. This will also cancel the existing insurance certificate.

Related: “End Of Service Calculator” | “Jafza Gratuity Calculator“| “Basic Salary In UAE“

Conclusion

ILOE Insurance is the foundation of financial security UAE. This compulsory scheme by MOHRE provides income protection UAE against job loss. Knowing ILOE eligibility criteria, ILOE premium cost (A/B), ILOE benefits (60% salary) and how to claim ILOE insurance is key. Manage your subscription proactively: pay ILOE premiums and renew ILOE Insurance via the Official ILOE Portal (iloe.ae) to avoid ILOE fines and stay covered.

If you need to claim benefits, follow the ILOE claim process and appeal if required. This ILOE Scheme is a big help during job transitions. With the low cost and big financial support, asking “is ILOE worth it?” is a definite yes for eligible workers. Coverage continues if you switch jobs ILOE and may cover ILOE probation termination if involuntary. Do not cancel ILOE insurance; it’s compulsory.

Frequently Asked Questions

Q1: Is ILOE Insurance mandatory for Free Zone employees?

A: Yes, Free Zone employees ILOE are generally required to subscribe, aligning with mainland and federal sectors.

Q2: Can I claim ILOE if I resign from my job?

A: No. The scheme covers involuntary job loss only. Voluntary resignation disqualifies you from claiming ILOE benefits.

Q3: How long do I need to pay premiums before I can claim?

A: A minimum contribution period of 12 consecutive months with paid premiums is required before eligibility to claim ILOE insurance.

Q4: What happens if I find a new job while receiving ILOE benefits?

A: ILOE payout stops upon starting new employment. Inform the insurance provider promptly.

Q5: Where can I check my ILOE subscription status and pay fines?

A: Use the Official ILOE Portal (iloe.ae) or the ILOE Mobile App. Log in with your Emirates ID to check status, view your ILOE Certificate, download ILOE certificate online, and check ILOE fine / pay ILOE premiums.